Past performance does not guarantee future performance.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

Data not available

Past performance does not guarantee future performance.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

- Part A EUR

-

Past performance does not guarantee future performance.

Source : HOMA CAPITAL

MTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date. - Part I EUR

-

Data not available

Past performance does not guarantee future performance.

Source : HOMA CAPITALMTD: Month To Date.

3Y*, 5Y* : annualized returns, in calendar year.

ITD: Inception to Date.

In a nutshell

This fund seeks to outperform the Bloomberg Barclays Euro Aggregate Corporate Index primarily through a selection of corporate and government bonds and falls under Article 9 of the SFDR regulations.*

The fund’s management objective is based on an investment strategy consisting of actively managing a diversified portfolio of bonds and other debt securities, via direct holdings and/or UCITS or FIAs.

The two performance drivers of the fund are :

- The remuneration of the interest rate risk via the sensitivity of the portfolio, permanently adapted to the expectations of the management team and the market conditions. This sensitivity is permanently between 2 and 6.

Remuneration for credit risk through a rigorous selection of issuers, with a preference for the highest rated companies (Investment Grade). The proportion of securities rated High Yield may not exceed 40% of the net assets.

* The SFDR Article 9 designates products with a sustainable investment objective, i.e., that invest in an economic activity that contributes to an environmental and/or social objective.

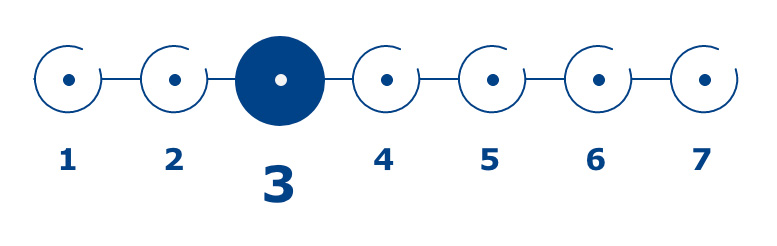

Risk level

Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. You may not recover the amount originally invested. Before taking any investement decision, please carefully read the prospectus available below.

Management team

CFA

ANALYST / PORTFOLIO MANAGER

CFA

ANALYST / PORTFOLIO MANAGER

Performance

Evolution of the net asset value since inception

Past performance does not guarantee future performance.

Data not available

Past performance does not guarantee future performance.

- Part A EUR

-

Past performance does not guarantee future performance.

- Part I EUR

-

Data not available

Past performance does not guarantee future performance.

Characteristics

LEGAL FORM

French mutual fund (FCP) incorporated in France

CURRENCY

Euro

INCEPTION DATE

June 14th, 2011

ASSET CLASSES

Corporate and Government bonds

ELIGIBILITY

Institutional Investors

ISIN CODE

FR0011048750

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Weekly

ORDER RECEPTION DEADLINE

4:00 pm, 1 business day before the relevant NAV date

CUSTODIAN

SOCIETE GENERALE S.A.

FUND VALUATION

SOCIETE GENERALE S.A.

AUDITOR

PricewaterhouseCoopers

LEGAL FORM

French mutual fund (FCP) incorporated in France

CURRENCY

Euro

INCEPTION DATE

February 26th, 2021

ASSET CLASS

Corporate and Government bonds

ELIGIBILITY

Institutional Investors

ISIN CODE

FR0014002AN3

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Weekly

ORDER RECEPTION DEADLINE

4:00 pm, 1 business day before the relevant NAV date

CUSTODIAN

SOCIETE GENERALE S.A.

FUND VALUATION

SOCIETE GENERALE S.A.

AUDITOR

PricewaterhouseCoopers

- Part A EUR

-

LEGAL FORM

French mutual fund (FCP) incorporated in France

CURRENCY

Euro

INCEPTION DATE

June 14th, 2011

ASSET CLASSES

Corporate and Government bonds

ELIGIBILITY

Institutional Investors

ISIN CODE

FR0011048750

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Weekly

ORDER RECEPTION DEADLINE

4:00 pm, 1 business day before the relevant NAV date

CUSTODIAN

SOCIETE GENERALE S.A.

FUND VALUATION

SOCIETE GENERALE S.A.

AUDITOR

PricewaterhouseCoopers

- Part I EUR

-

LEGAL FORM

French mutual fund (FCP) incorporated in France

CURRENCY

Euro

INCEPTION DATE

February 26th, 2021

ASSET CLASS

Corporate and Government bonds

ELIGIBILITY

Institutional Investors

ISIN CODE

FR0014002AN3

RECOMMENDED INVESTMENT PERIOD

At least 3 years

DISTRIBUTION POLICY

Capitalization

NAV CALCULATION

Weekly

ORDER RECEPTION DEADLINE

4:00 pm, 1 business day before the relevant NAV date

CUSTODIAN

SOCIETE GENERALE S.A.

FUND VALUATION

SOCIETE GENERALE S.A.

AUDITOR

PricewaterhouseCoopers

Management fees

MANAGEMENT FEE

Maximum 0.45%

PERFORMANCE FEE

N/A

SUBSCRIPTION FEE

N/A

ONGOING CHARGES

N/A

MANAGEMENT FEE

Maximum 0.55%

PERFORMANCE FEE

N/A

SUBSCRIPTION FEE

N/A

ONGOING CHARGES

N/A

- Part A EUR

-

MANAGEMENT FEE

Maximum 0.45%

PERFORMANCE FEE

N/A

SUBSCRIPTION FEE

N/A

ONGOING CHARGES

N/A

- Part I EUR

-

MANAGEMENT FEE

Maximum 0.55%

PERFORMANCE FEE

N/A

SUBSCRIPTION FEE

N/A

ONGOING CHARGES

N/A

Legal documents

(French version only)

(French version only)

(French version only)

Marketing documents

Reporting February 2025 (French version available only)

Previous monthly reports are available upon request via email contact@homacapital.fr

Not available

- Part A EUR

-

Reporting February 2025 (French version available only)

Previous monthly reports are available upon request via email contact@homacapital.fr

- Part I EUR

-

Not available